|

INVESTING

IN TURKEY

I.

INTRODUCTION

SITUATED

AT THE CROSSROADS OF EUROPE, ASIA AND AFRICA TURKEY IS A PLURALISTIC,

PARLIAMENTARY AND SECULAR DEMOCRACY, BORN FROM THE 700 YEARS LONG

HERITAGE OF THE OTTOMAN EMPIRE.

MUSTAFA

KEMAL ATATÜRK FOUNDED THE TURKISH REPUBLIC IN 1923. BEING PRESIDENT

UNTIL HIS DEATH IN 1938, HE LINKED TURKEY’S FATE TO THE WEST

THROUGH THE ADOPTION OF THE LATIN ALPHABET, WESTERN LEGAL SYSTEM AND

MODERN LIFE STYLE.

WITHIN

THE ISLAMIC HEMISPHERE TURKEY IS THE ONLY SECULAR DEMOCRACY,

REPRESENTING A MODEL, THE IMPORTANCE OF WHICH IS HIGHLY APPRECIATED

NOWADAYS.

TURKEY

REMAINS STRONGLY TIED TO THE WEST THROUGH HER POSITION WITHIN NATO,

RELATIONS WITH THE WORLD BANK AS WELL AS HER MEMBERSHIP IN THE

EUROPEAN COUNCIL.

ÝNSPITE

OF EVENTUAL SHORT-TERM POLITICAL TURBULENCES TURKEY HAS A STRONG AND

STABLE REGIME AND IS PRESENTLY IMPLEMENTING SOCIAL, FISCAL, MONETARY

AND ECONOMIC STRUCTURAL REFORMS TO PAVE THE WAY FOR A FULL EU

MEMBERSHIP, TO WHICH SHE HAS ALREADY A CUSTOM’S UNION RELATION.

THE

COUNTRY COVERS AN AREA ALMOST THE SIZE OF FRANCE AND GERMANY

COMBINED WITH A POPULATION OF 68 MILLION, THE SECOND LARGEST AND

MOST YOUTHFUL IN EUROPE.

TURKEY

HAS A DIVERSIFIED GEOGRAPHY, RICH NATURAL RESOURCES, STRONG

AGRICULTURE, AND RELATIVELY DEVELOPED INFRASTRUCTURE, MODERN AND

ADVANCED INDUSTRY, SKILLED AND COMPETITIVE HUMAN CAPITAL.

THANKS

TO THE MAJOR STRUCTURAL REFORMS IN THE EARLY 80’S, TURKEY HAS

TODAY AN OPEN AND MARKET DRIVEN LIBERAL ECONOMY, FULLY INTEGRATED TO

THE GLOBAL SYSTEM.

THE

EXISTING LIBERAL FOREIGN INVESTMENT LEGISLATION REPRESENTS A WELL-SECURED,

RELIABLE, STABLE AND ENVIRONMENT FOR FOREIGN CAPITAL, EXPERIENCED

AND APPRECIATED BY MORE THAN 5500 FOREIGN CAPITAL FIRMS ALREADY.

II.

ADVANTAGES AND GOOD REASONS

IN

AN ENVIRONMENT WHERE MANY EMERGING ECONOMICS COMPETE FOR THE

ATTRACTION OF FOREIGN DIRECT INVESTMENT TURKEY OFFERS VARIOUS

UNBEATABLE ADVANTAGES

üUNIQUE

GEOGRAPHICAL AND GEOPOLITICAL LOCATION

TURKEY

ENJOYS A UNIQUE LOCATION, BRIDGING EUROPE, ASIA AND AFRICA AND

DOMINATES A VERY CRUCIAL GEOPOLITICAL POSITION. HER PROXIMITY TO THE

EMERGING MARKETS IN THE BALKANS, BLACK SEA, MIDDLE EAST, NORTH

AFRICA AND CENTRAL ASIA, AS WELL AS HER CULTURAL TIES WITH CENTRAL

ASIAN COUNTRIES, CREATE LUCRATIVE BUSINESS OPPORTUNITIES. TURKEY IS

THE LEADING INVESTOR IN CAUCASIAN AND CENTRAL ASIAN TURKIC REPUBLICS

AND WITH HER PRIVILEGED ACCESS SHE CAN PROVIDE A PERFECT BASE TO

DEVELOP BUSINESS WITH THESE COUNTRIES.

TURKEY

IS LOCATED ADVANTAGEOUSLY IN TERMS OF NATURAL RESOURCES AS WELL.

AGRICULTURE,

ORE RESERVES, TOURISTIC ATTRACTIONS AND RICH SWEET WATER POTENTIAL,

WHICH WILL BECOME A STRATEGIC GOOD IN THE REGION, ARE IMPORTANT

NATURAL RESOURCES, OPEN TO DEVELOPMENT.

üA

HUGE DOMESTIC MARKET

WITH

A POPULATION OF 68 MILLION TURKEY OFFERS A HUGE AND DYNAMIC DOMESTIC

MARKET TO INVESTORS.

THE

CONSUMPTION LEVELS HAVE BEEN INCREASING DUE TO RAPID WEALTH

FORMATION, IMPROVING EDUCATION AND AWARENESS, DEVELOPING MARKETING

TECHNIQUES AND A GROWING URBANIZATION RATE.

ALTHOUGH

THE UNEVEN DISTRIBUTION OF WEALTH AMONG REGIONS AND INDIVIDUALS

PROVIDES A HANDICAP, IT ALSO IMPLIES A LARGE SEGMENT OF THE

POPULATION WHO ENJOY THE SAME HIGH LIVING STANDARDS AS PEOPLE IN

MORE DEVELOPED COUNTRIES. ACCORDING TO CALCULATIONS BY ÝNVESTA A

POPULATION OF AT LEAST 12 MILLION IN THE WESTERN PART OF THE COUNTRY

ENJOY AN AVERAGE INCOME OF MORE THAN US $ 15.000 BASED ON PURCHASING

POWER PARITY. THIS MAKES TURKEY MORE ATTRACTIVE THAN MANY MEDIUM-SIZED

EUROPEAN MARKETS.

AS

A RESULT OF PRESENT LOWER PER CAPITA CONSUMPTION, THE GROWTH RATES

IN MANY INDUSTRIES IN TURKEY, SUCH AS PACKAGING, RETAIL, PLASTICS,

WHITE GOODS, BUILDING MATERIALS, PROCESSED FOOD AND BEVERAGES, FAST-MOVING

CONSUMER GOODS ARE MUCH HIGHER THAN THEIR COUNTERPARTS IN DEVELOPED

COUNTRIES WHERE THE CONSUMPTION LEVELS ARE ALREADY SATURATED.

üEXPORT

POTENTIAL

TURKEY’S

IDEAL LOCATION AND RELATIONS WITHIN HER REGION, SUPPORTED BY

GOVERNMENTAL INCENTIVES FOR EXPORTS, TURNS TURKEY INTO AN EXPORT

BASE COVERING A MARKET WITH A POPULATION OF ALMOST 200 MILLION.

THE

CUSTOMS UNION WITH EU PROVIDES AN EASY ACCESS INTO THE EUROPEAN

DEVELOPED MARKETS, AND REPRESENTS A HIGHLY APPRECIATED ADVANTAGE TO

OVERCOME TAX AND TARIFF BARRIERS FOR INVESTORS FROM THIRD COUNTRIES.

üA

FAST DEVELOPING ECONOMY

THE

ECONOMY GREW BY AN AVERAGE 6.8 PERCENT BETWEEN 1995 AND 2002, WHICH

IS WELL ABOVE THE GROWTH RATE OF OECD COUNTRIES, SUGGESTING A

DYNAMIC AND DEVELOPING ECONOMY. NEVERTHELESS, THE WORLD TRADE

ORGANIZATION STATES THAT TURKEY IS AMONG THE 20 MOST DYNAMIC

COUNTRIES IN TERMS OF WORLD TRADE.

MANY

SERVICE AND MANUFACTURING SECTORS ENJOY TREMENDOUS GROWTH RATES IN

TURKEY, PARTLY BECAUSE OF LOWER PENETRATION RATES THAN THOSE OF MORE

DEVELOPED COUNTRIES ELSEWHERE IN EUROPE, AND THE APPETITE IS

CORRESPONDINGLY GREATER.

üHIGH

SKILLED HUMAN RESOURCES

TURKISH

LABOUR FORCE IS WELL KNOWN WITH IT’S SKILLS AND LEARNING CAPACITY

AS VOCATIONAL EDUCATION IS EMPHASIZED IN THE TURKISH EDUCATION

SYSTEM.

INEXPENSIVE

LABOUR RATES MAKING TURKEY HIGHLY COMPETITIVE WITH OTHER EMERGING

MARKETS AS WELL AS WITH THE REST OF THE WORLD, OFFER CUTTING EDGE

FOR INDUSTRIES.

ON

THE OTHER HAND THE LEVEL OF WHITE-COLLAR EMPLOYEES AND PARTICULARLY

THE EXECUTIVE LEVEL HAVE OUTSTANDING QUALIFICATIONS AND CAPACITIES

COMPARABLE TO A DEGREE AS APPRECIATED ANYWHERE IN EUROPE AND USA.

FINALLY

TURKISH ENTREPRENEURS, WITH THEIR INTELLECT AND DRIVING POWER ARE

PLAYING NOW IN THE INTERNATIONAL LEAGUE AND REPRESENT RELIABLE

PARTNERSHIP POTENTIAL FOR FOREIGN INVESTORS.

üHIGH

QUALITY STANDARDS

THE

NEW QUALITY ORIENTED GENERATION IN BOTH MANUFACTURING AND SERVICES

SECTORS ENSURES HIGH QUALITY LEVELS: THIS IS ALSO PROVEN BY TURKISH

COMPANIES WINNING THE EUROPEAN QUALITY AWARD SUCH AS: BRISA, BEKSA, NETAS, BEKO, ARCELIK, ECZACIBASI VITRA.

üDEVELOPED

INFRASTRUCTURE

MOST

RESIDENTIAL AREAS BENEFIT FROM SATISFACTORY ELECTRICITY, DRAINAGE,

NATURAL GAS, TELECOMMUNICATIONS AND TRANSPORTATION SERVICES.

MOREOVER, IN ADDITION TO LARGE FACTORIES, THE GOVERNMENT PROVIDES

“FREE ZONES” AND SO-CALLED “ORGANIZED INDUSTRIAL ZONES”

DESIGNED FOR SMALL AND MEDIUM-SIZED ENTERPRISES.

TURKEY

HAS A RELATIVELY YOUNG AND EFFICIENT TELECOMMUNICATIONS NETWORK WITH

THE LATEST TECHNOLOGY. MOBILE TELEPHONE COVERAGE HAS BEEN EXTENDED

THROUGH THE COUNTRY.

THE

TURKISH FINANCIAL SECTOR IS WELL DEVELOPED IN BOTH TECHNOLOGY AND

LEGAL PROCEDURES. THE BANKING SYSTEM, WHICH UNDERWENT A

RESTRUCTURING ALONG WITH IMF POLICIES, IS EFFICIENT AND THE ÝSTANBUL

STOCK EXCHANGE (ISE) WHICH IS THE LARGEST AND THE MOST ACTIVE IN THE

REGION, PROVIDES ADEQUATE LIQUIDITY TO 280 QUOTED STOCKS WITH A

MARKET CAP OF 50 BILLION US. DOLLARS.

TURKISH

GOVERNMENT AGENCIES SUCH AS THE STATE INSTITUTE OF STATISTICS, THE

CENTRAL BANK, THE TREASURY, THE STATE PLANNING ORGANIZATION, AND THE

ISE ARE MUCH MORE EFFICIENT AND TIMELY, IN PROVIDING DATA ON VITAL

STATISTICS, THAN THE AGENCIES IN OTHER EMERGING COUNTRIES.

üTHE

GATEWAY OF ENERGY RESOURCES

TURKEY

IS PLACED AT THE CROSSROADS OF WORLD’S FUTURE ENERGY RESOURCES,

NAMELY MIDDLE EASTERN AND CASPIAN OIL AS WELL AS RUSSIAN AND CENTRAL

ASIAN NATURAL GAS THAT ARE LINKED THROUGH PIPELINES TO TURKISH

MEDITERRANEAN HARBORS AND WESTERN COUNTRIES.

üLEGAL

PROTECTION

TURKEY

HAS ONE OF THE MOST FLEXIBLE AND UNRESTRICTED LEGAL REGIMES

GOVERNING FOREIGN INVESTMENT, SUPPORTED ALSO BY THE FULL

CONVERTIBILITY OF THE LOCAL CURRENCY.

THERE IS NO DISCRIMINATION AGAINST FOREIGN INVESTORS AT ANY

STAGE OF AN INVESTMENT. TURKEY GRANTS ALL RIGHTS, INCENTIVES,

EXEMPTIONS AND PRIVILEGES AVAILABLE TO DOMESTIC INVESTORS ALSO TO

FOREIGNERS. THERE ARE NO RESTRICTIONS ON ACTIVITY AREAS, ON CAPITAL

MOVEMENTS, ON TRANSFER OF PROFITS, ON CREDIT ACQUISITIONS, ON

REPATRIATION OF CAPITAL IN CASE OF LIQUIDATION OR SALE AND ON

EMPLOYMENT OF FOREIGNERS. THERE IS NO LIMIT ON EQUITY PARTICIPATION

RATIOS, AND APPROVAL PROCEDURES FOR FOREIGN DIRECT INVESTMENT HAVE

BEEN SIMPLIFIED.

APART

FROM THE LIBERAL LEGISLATION, TURKEY PROVIDES ALSO A SECURE

ENVIRONMENT FOR FOREIGN CAPITAL. THE LAW FOR THE PROTECTION OF

COMPETITION HAS BEEN IN EFFECT SINCE 1994, INTERNATIONAL ARBITRATION

IN GOVERNMENT TENDERS HAS BEEN ACCEPTED SINCE 2000 AND SUBSTANTIVE

MEASURES FOR THE PROTECTION OF INTELLECTUAL PROPERTIES AND

INDUSTRIAL RIGHTS HAVE BEEN TAKEN IN THE LAST YEARS.

üPRIVATIZATION

OPPORTUNITIES

TURKEY

IS INCREASING HER PRIVATIZATION EFFORTS TO TURN LOW PERFORMING

GOVERNMENTAL ENTERPRISES INTO COMPETITIVE ECONOMIC ENTITIES.

THE

PRIVATIZATION PROGRAMME OFFERS UNIQUE AND GREAT OPPORTUNITIES TO

INVESTORS FOR ENTERING INTO HUGE ENERGY, TELECOMMUNICATION,

TRANSPORTATION AND INFRASTRUCTURE INVESTMENTS WITH A CAPTURED

MARKET.

III.

CHALLENGES TO FACE

!

POLITICS

AND BUREAUCRACY

DESPITE

TURKEY’S 55 YEARS HISTORY OF PLURALISTIC DEMOCRACY, OCCASIONAL

POLITICAL VOLATILITIES HAVE DISCOURAGED FOREIGN DIRECT INVESTMENT IN

THE PAST. DUE TO THE WIDE SPECTRUM OF POLITICAL PARTIES AND

IDEOLOGIES, THERE HAVE BEEN PERIODS WHERE FOREIGN DIRECT INVESTMENTS

FACED PREJUDICES AND DIFFICULTIES.

HOWEVER

IN THE RECENT YEARS THE POLITICAL AND ECONOMICAL IDEOLOGIES AMONG

THE PARTIES ARE CONVERGING AND THIS OPENED THE GATE TO THE LONG

AWAITED STRUCTURAL REFORMS IN BANKING, AGRICULTURE, PRIVATIZATION

AND OTHER AREAS.

TODAY

WITH HER STRONG ONE PARTY MAJORITY GOVERNMENT TURKEY HAS A VERY

POSITIVE ATTITUDE TOWARDS FOREIGN DIRECT INVESTMENTS, HOWEVER

COMPLEX REGULATIONS AND BUREAUCRACY COULD NOT HAVE BEEN FULLY

SIMPLIFIED YET.

WHILE

DOING BUSINESS IN TURKEY, FOREIGN INVESTORS MAY BE FORCED TO FOLLOW

UP ISSUES AT VARIOUS GOVERNMENTAL AGENCIES SUCH AS;

-

MINISTRY OF FINANCE

-

MINISTRY OF INDUSTRY AND TRADE

-

MINISTRY OF ENERGY

-

MINISTRY OF TOURISM

-

MINISTRY OF ENVIRONMENT

-

MINISTRY OF LABOUR AND SOCIAL SECURITY

-

CENTRAL BANK OF TURKEY

-

UNDERSECRETARIAT OF TREASURY

-

UNDERSECRETARIAT OF DEFENSE INDUSTRY

-

UNDERSECRETARIAT OF CUSTOMS

-

PRIVATIZATION ADMINISTRATION

-

CHAMBER OF COMMERCE

-

CHAMBER OF INDUSTRY

AND

AT THE INDEPENDENT REGULATORY BODIES WHICH ARE

-

THE CAPITAL MARKETS BOARD

-

THE BANKING REGULATION AND

SUPERVISION BOARD

-

THE ELECTRICITY MARKET REGULATION

BOARD

-

THE PUBLIC TENDER SUPERVISION BOARD

-

THE COMPETITION BOARD

-

THE TELECOMMUNICATION BOARD

-

THE SUGAR BOARD

-

THE TOBACCO AND ALCOHOLIC

BEVERAGES MARKET REGULATION BOARD

-

THE RADIO TELEVISION BOARD

FACED

WITH SUCH COMPLEX AND CONFUSED SITUATION FOREIGN INVESTORS HAVE

FORMED AND ESTABLISHED YASED (FOREIGN CAPITAL ASSOCIATION) TO ACT

COLLECTIVELY IN THE DIALOGUES TO IMPROVE THE ENVIRONMENT FOR FOREIGN

DIRECT INVESTMENTS AND REDUCE RED TAPE.

IN

SPITE OF THIS DISCOURAGING PICTURE, PROCEDURES CAN BE EXTREMELY

ACCELERATED THROUGH CLOSE FOLLOW UP, PERSONAL RELATIONS AND DIALOGUE

WITH THE RELATED POLITICAL LEVELS AND AGENCIES THAT

SURPRISINGLY IN GENERAL ARE VERY HELPFUL TOWARDS FOREIGN CAPITAL.

THEREFORE

FOREIGN INVESTORS IN TURKEY, MORE THAN ANYWHERE ELSE NEED LOCAL

GUIDANCE FOR THEIR AND THEIR WAY THROUGH THE REGULATORY PROCEDURES

AND POLITICAL DIALOGUES.

!

UNREGISTERED

ECONOMY

AS

A REACTION AGAINST HIGH INFLATION OVER ALMOST TWO DECADES, AN

IMPORTANT PORTION OF THE ECONOMY ESCAPED REGISTRATION. ALTHOUGH

ILLEGAL THIS “PARALLEL ECONOMY” WHICH IS ESTIMATED TO BE 40% OF

THE OVERALL ECONOMY, IS A FACT AND REPRESENTS NOT ONLY A SIGNIFICANT

LOSS OF TAXES FOR THE FISCAL SYSTEM, BUT ALSO CREATES UNFAIR

COMPETITION ON THE MARKET.

ON

THE OTHER HAND AS, THESE UNREGISTERED ECONOMIC ACTIVITIES ARE NOT

INCLUDED IN THE OFFICIAL STATISTICS; THESE DO NOT REPRESENT THE REAL

SITUATION. THEREFORE IT CAN BE ASSUMED THAT THE REAL GDP AND CONSUME

FIGURES ARE MUCH HIGHER THAN REFLECTED IN THE STATISTICS. THE

EVALUATION OF THIS FACT IS IMPORTANT WHEN ACCESSING THE REAL MARKET

POTENTIAL OF TURKEY.

THE

GOVERNMENT, ALSO SUPPORTED BY THE DECREASING INFLATION, HAS

LAUNCHED A DEDICATED PROGRAMME TO ELIMINATE THIS CRONICAL DISEASE,

WHICH WILL HELP TO NORMALIZE THE SITUATION.

!

LACK

OF FINANCE

INCREASED

GOVERNMENT BORROWING FROM 1990 ONWARDS HAS EXHAUSTED ALMOST ALL

DOMESTIC SOURCES AND PRIVATE SECTOR COMPANIES FACE SERIOUS HANDICAPS

TO COVER THEIR FINANCING FROM THE DOMESTIC BANKING SYSTEM OR THROUGH

OTHER CAPITAL MARKET INSTRUMENTS.

SCARCELY

AVAILABLE CREDITS ARE SHORT TERMED AND CARRY A VERY HIGH INTEREST

BURDAIN.

THIS,

FOR THE OVERALL ECONOMY UNLUCKLY SITUATION HOWEVER, CREATES GREAT

ADVANTAGES FOR COMPANIES WITH FOREIGN DIRECT INVESTMENT, WHO THROUGH

THE SUPPORT OF THEIR SHAREHOLDERS MAY HAVE EASY ACCESS TO

COMPETITIVE INTERNATIONAL FINANCE SOURCES.

!

MANAGEMENT

PHILOSOPHY

WITH

VERY FEW EXCEPTIONS, MOST TURKISH BUSINESS GROUPS AND COMPANIES ARE

FAMILY CONTROLLED OPERATIONS.

THEREFORE

WHEN COLLABORATING WITH A TURKISH PARTNER FOR A NEW VENTURE OR

ACQUIRING SHARES IN AN EXISTING COMPANY, USUALLY DEPENDENCY TO THE

FORMER OWNER FAMILY, INADEQUATE INSTITUTIONAL MANAGEMENT,

INSUFFICIENT ACCOUNTING STANDARTS, IMPROPER INFORMATION SYSTEMS MAY

BE EXPECTED AS PROBLEM AREAS. ARMS LENGTH RELATIONS BETWEEN COMPANY

AND OWNER OR OWNER’S OTHER COMPANIES ARE ALSO QUITE USUAL AND

PROBLEMATIC.

THE

OVERCOMING OF THE GAP BETWEEN THE OWNER MANAGEMENT AND INSTITUTIONAL

MANAGEMENT REQUIRES DELICACY AND TIME.

THE

INVOLVEMENT OF CONSULTANTS OR TURKISH BOARD MEMBERS ALSO RESPECTED

BY THE TURKISH COUNTERPART IS ALMOST A MUST AND VERY RECOMMENDABLE

TO OVERCOME THE INITIAL PROBLEMS.

|

|

|

|

|

IV.

FORMS OF

BUSINESS ORGANISATIONS

The Turkish

Commercial Code recognises two distinct types of business

enterprise;

Partnerships

Corporations

The legal

differences between the two concern the allocation of

liability and the legal identity of the entity. Corporations

established by foreign joint venture partners with or

without a Turkish partner are treated as Turkish

corporations and are entitled to all rights available to

Turkish companies under the Turkish commercial code.

Foreign

investors may establish a corporation in either of these two

forms:

Limited

Liability Company (Limited Sirket - Ltd. Sti.)

Joint

Stock Company (Anonim Sirket - A.S.)

These

business types exist as separate legal entities and offer

their shareholders limited liability. The most common type

of business entity in Turkey is the joint stock company and

generally foreign investors establish such corporations for

doing business in Turkey.

Joint

Stock Company

A joint stock

company is defined as a corporation having its own trade

name and a predetermined amount of capital divided by shares.

The liability of the shareholder is limited to their capital.

The structure

and organisation of joint stock companies are subject to

regulation by the Turkish Commercial Code. However, the

founders of joint stock companies are afforded significant

flexibility in drafting the articles of association, thereby

serving the needs of the specific venture. Capital Market

Board regulations also apply to joint stock companies whose

shareholders' number at least 250, or who have issued bonds

or whose shares are quoted on the Istanbul Stock Exchange.

A minimum of

five shareholders, who may be either real persons or legal

entities, are required for the formation of a joint stock

company. The overall share capital must be a minimum of 5

billion TL and the minimum capital contribution by each

foreign shareholder is US $ 50,000.

The capital

of a joint stock company is divided into shares of equal

value which are treated as negotiable commercial paper. The

shares may be issued in either registered or bearer form.

Registered shares are freely transferable subject to

approval by the board of the company, unless prohibited by

the company's articles of association. Bearer shares are

freely transferable under the Code of Obligations, unless

otherwise agreed by the parties.

Decision

making in a joint stock company is by majority vote; but the

Turkish Commercial Code includes certain provisions to

protect minority interests. Minority shareholders may also

request the appointment of a special auditor on their behalf.

Limited

Liability Company

Limited

liability companies may be composed of real persons or legal

entities and must consist of at least 2 and no more than 50

partners. The overall share capital must be a minimum of 500

million TL and the minimum capital contribution by each

foreign shareholder is the TL equivalent of US $ 50,000. All

partners are personally liable for the debts of the company

up to a maximum of their contribution, however, partners are

not held liable for the unpaid portions of others'

contributions. They are also more directly exposed to the

tax liabilities of the company, limited however to their own

shares.

Shares held

in a limited liability company are non-negotiable and may be

transferred only with the approval of the other partners.

Transfers must be approved by at least a 75% majority vote,

with at least 75% of the total capital represented. Limited

liability companies are also prohibited from engaging in

banking or insurance business. A limited liability company

differs from the joint stock company in that its capital is

not divided into shares of stock nor represented by share

certificates. There is no board of directors for a limited

company. Instead, the appointed manager has authority to run

the company.

Branches

and Liaison Offices

Foreign

companies may also operate through liaison offices or

branches providing they are established in accordance with

the relevant legislation. The income of a branch derived in

Turkey is taxed in the same way as resident corporations.

Liaison

offices may be used to establish a presence in Turkey, but

may not carry on any commercial activity and must be funded

by the parent company outside Turkey.

Employing

Foreign PersonNel

Foreign

personnel can be employed in Turkey with the permission of

General Directorate of Foreign Investments. Companies can

apply to employ foreign personnel, but a real person cannot

make an application by himself.

The

applications are made directly to the General

Directorate of Foreign Investments and the applications are

evaluated according to a specific criteria where the

qualifications of the personnel and the performance of the

company are taken into account.

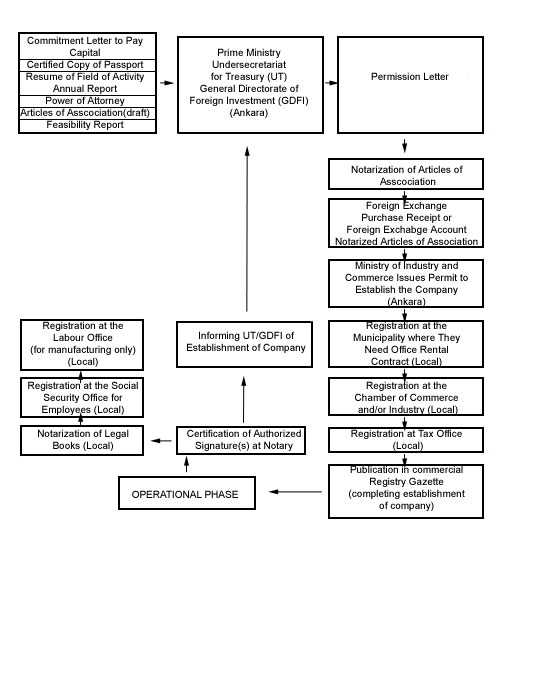

V.

ROADMAP FOR ESTABLISHING A FOREIGN CAPITAL COMPANY IN TURKEY

|

|